*Short-Note* Controversy @ Copart Inc (NASDAQ: CPRT) - Quick Notes on Recent "Debauchery" Culture in the C-Suite, Potential Schemes W/ Broker Network, & Shill-Bidding Allegations

*Short-Note* Controversy @ Copart Inc (NASDAQ: CPRT) - Quick Notes on Recent "Debauchery" Culture in the C-Suite, Potential Schemes W/ Broker Network, & Shill-Bidding Allegations

Note that this post is shorter that what I usually try to put out on the short-bias side on socials, here, and VIC, but with CPRT reporting last week, I thought it was interesting. Ended up typing up my thoughts below over the weekend; while not as robust as a multi-week investigation would yield, I still think there are tidbits that should be out there for investors to digest.

Quick Summary

Copart Inc (CPRT) stock is down ~14% YTD so far and is down ~24% from its peak share-price of $63.84, largely due to share-loss gains due to the Resurgent IAA under Ritchie Bros thesis. That thesis has been well-documented on X, sell-side notes, and alternative data providers (like Yippit). CPRT reported earnings last Thursday, which received a polarizing reaction online; some users are skeptical of the 5.6% ASP growth, if share-loss is truly just a one-time step-down due to contract lumpiness, and how growth looks next year. I do not have many intelligent thoughts on ASP growth, share-loss, etc. beyond what is already out there, however, I am concerned about the character and aptitude of certain senior members of the CPRT team. I am neither long, nor short, (albeit do hold a bearish view over the next 12-18 months), but view the below as indicative of either 1) management’s competence, and 2) management’s character. See below for a quick excerpt of a post on X I made last Friday that summarizes the main implications of what this write-up will discuss:

“You have to consider the implications IF the claims re: sexual harassment, company money being spent on prostitutes, massive drinking culture in the office / during meetings, are all true. Does it matter for EPS? Probably not right now (no means is this fraud), but if it is true, it speaks to the character of some of the VPs and higher-ups. Will they be entirely truthful, especially at a time where IAA is taking share? Sure, the CEO and CFO are the face of the company, but they rely on the alleged perpetrators a lot as well given how lean the company is (in my opinion). Do you also want company executives to show up to meetings drunk when they're in the most competitive environment they've been in for the last 4-5 years? Again, no position, but I'm surprised this hasn't seen more coverage.”

Beyond the analysis of character / competence, recent lawsuits and online reviews reveal allegations of potential fraudulent schemes that may be present at the company. One lawsuit alleges that CPRT knowingly sells vehicles that are severely damaged beyond what is advertised to brokers who in turn sell them to the end-customer; by introducing this 3rd party broker, CPRT claims that the user in question is not the owner, and any complaints essentially go into a black box. There are also numerous instances where CPRT is allegedly blatantly listing the wrong information and history about a salvaged car which users found out through a reverse-VIN look-up. A former employee has recently also accused CPRT of having a division dedicated to just “shill-bidding”, an illegal practice in some states, and controversial across the country. Strangely enough, CPRT just updated their risk disclosure within their Q3 FY2025 10-Q to include wording around the risk of “government investigations”; while it may just be run-of-the-mill updates, the timing is suspicious.

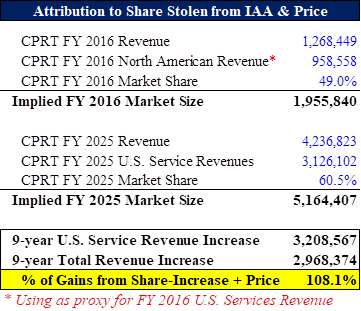

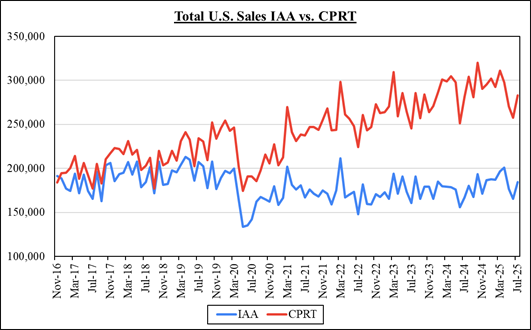

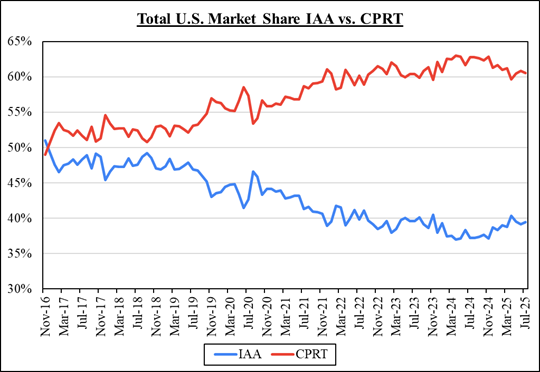

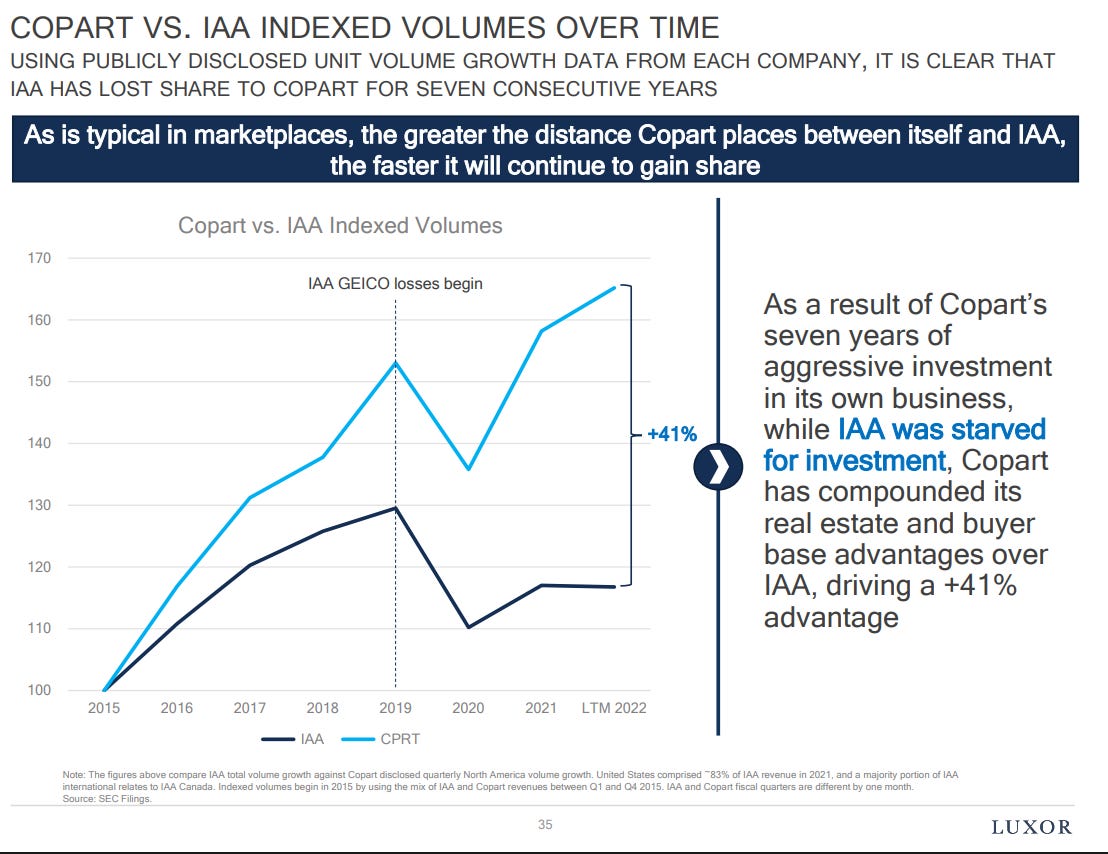

To quickly cover the fundamental bear-case, pre-2015 / 2016, CPRT operated in a duopolistic market where there was an even share-split between them and the only other competitor at scale, IAA. CPRT market-share went from ~41% in November 2016, to ~61% today, in large part due to IAA having a dysfunctional website and failing to deliver during catastrophic events (CAT events). This was largely due to IAA constantly on the figurative ownership merry-go-round, which has since changed through the Ritchie Bros acquisition of IAA in March 2023. Since then, IAA has cleaned-up shop, and their offering has become on-par with that of CPRT. While I do acknowledge the bull-debate that CPRT can defend the share they’ve gained, I view it as an uphill battle as CPRT customers, the insurance companies, WANT a 1-to-1 to split between the 2 companies as to not be squeezed by either / have enough diversification risk. It’s hard to see a world where CPRT maintains their share when their own customers are looking to ensure IAA gets an even-cut of their business now that they’ve gotten their house in order.

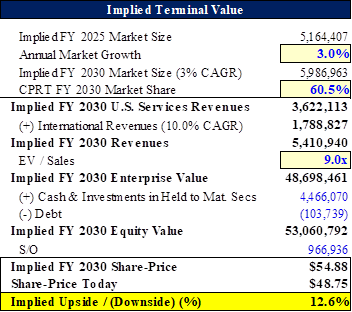

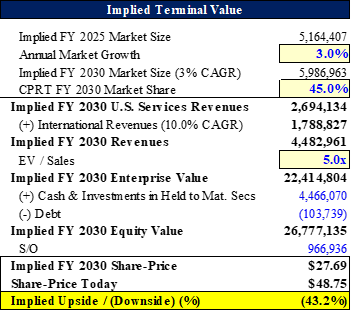

CPRT currently trades at a 9.8x TEV / FY+1 Sales multiple; assuming by 2030E their share erodes from ~61% to ~50%, that should re-enforce the multiple compression thesis and flowing these dynamics into the model at a 7.0x TEV / FY+1 Sales multiple, I see ~25% downside. If CPRT does see their share compress down to ~50%, the market would likely buy-in to the share-loss story to IAA and underwrite their share normalizing back down to ~45%; in this scenario, the multiple likely compresses back down to ~5.0x sales, which leads to ~43% downside. On an EBITDA multiple basis, their current ~21x TEV / FY+1 EBITDA multiple implies ~5% terminal growth; in a world where they are giving up share, it’s hard to see where they aren’t growing at a low-single digits growth rate instead. Assuming a 2.5% terminal growth rate, the implied terminal EBTIDA multiple for CPRT would be ~13.3x, a ~37% decline.

Anyways, see below for a quick bullet summary and thoughts:

Bullet Summary: Controversy W/ Upper Management, Alleged Fraudulent Schemes by Consumers & Ex-Employees, & Market Share Normalizing Implies ~20% - ~46% Downside

A recent lawsuit filed by the former Global VP of Human Relations in April 2025 titled “Christine Arnold vs. Copart, Inc.” reveals a culture at CPRT of executives showing up to meetings drunk, being caught with prostitute at company sponsored events (and forcing HR to accommodate them), and a large male executive almost cornering the plaintiff and screaming at her when she spoke against this internally

Beyond this, a recent May 2025 lawsuit alleges that CPRT sells vehicles that are materially different from what a VIN search would give you and forensic analysis of the car, however, by selling through 3rd-party brokers, CPRT creates a figurative “black-box”, shielding them from potential liability:

1. Post low quality pictures of vehicles on website (photos with small size, capacity, and limited pixels – when enlarged, they become blurrier and out of focus)

2. Advertise vehicle as “run and drive”, and then conceal the damage

3. Place a 3rd party between itself and actual buyer – CPRT then claims the person who searched for the vehicles, etc. is the actual buyer

a. The brokers for their part claim to have no part in advertising, the sale or the purchase of the vehicle (in some states, you need to have a broker)

Additionally, countless records of CPRT seemingly tampering with cars to hide damage, selling cars factually worse than listed online, and sometimes with fake titles / wrong titles in the cars (beyond just CPRT selling a “bad used car” - this is material differences in advertising)

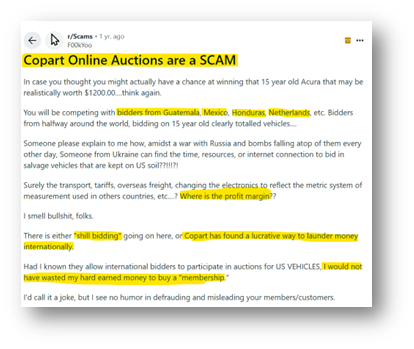

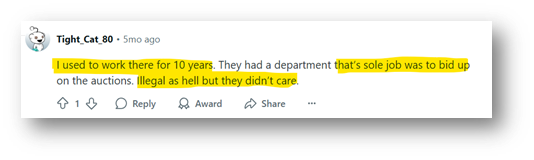

An ex-employee alleges that CPRT consistently engages in shill-bidding, and that they even had an entire department of the company dedicated to the practice

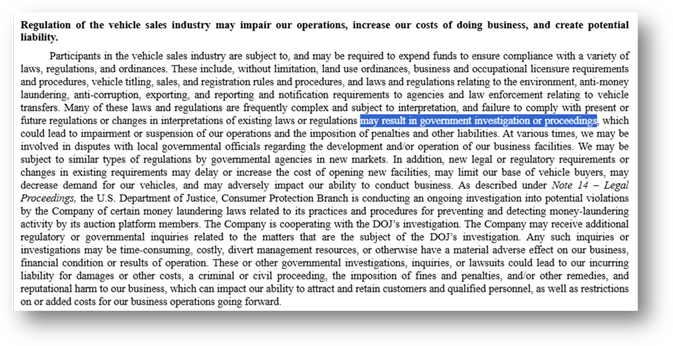

The Q3 FY2025 10-Q updated their risk disclosure to include the impact of "government investigation" - not a smoking gun, but the coincidence in timing is a little suspicious

CPRT has increased their share of the total industry from 41.0% to 60.5% over November 2016 to today per 3P data, primarily due to weakness in IAA (no functioning website, etc.). Now that IAA, under new ownership, has rectified these issues, insurance companies WANT to have EQUAL SHARE amongst the 2 largest salvage vehicle providers, and are going to the main driving force in share normalizing:

Market expectations price in ~60.5% share at a 9.0x TEV / FY+1 Sales, however, assuming CPRT share compresses to ~50% by 2030E, the multiple should re-rate down to 7.0x, which gives ~20% downside; by then, the market should begin to accept the IAA share re-gain thesis, leading to underwriting ~45% terminal share at a 5.0x multiple, giving us ~43% downside

Upper Management Has Alleged Culture of Debauchery

On April 9th, 2025, the former Global Head of Human Relations at CPRT filed a lawsuit, titled “Christine Arnold vs. Copart, Inc”. All of the documents on the docket are publicly available here.

The plaintiff spent 17 years at CPRT and was the Global Vice President of Human Resources for CPRT. She was never given a bad review and was consistently given the highest performance ratings and bonuses – for example, in October 2022 prior to her termination, she received an “Exceeds expectations” review from her seniors. She was allegedly fired after speaking out after being a victim of sexual harassment, a significant pay-gap between male and female employees, and gross conduct from male employees at company sponsored events where she was forced to accommodate them with prostitutes:

“Among other unlawful acts, she was inundated with inappropriate and sexually suggestive details about “men only” parties; verbally berated for opposing gender discrimination and sexual harassment; yelled at and physically blocked from exiting her office; and forced to accommodate male executives caught with prostitutes at company events”

This lawsuit also exposes suggestive male-only Yacht parties in Miami, and the “Burn it Down” shooting parties at the Copart Ranch in Celina, Texas - there was also a “superspreader poker night hosted by the brother of Copart’s CEO amid the COVID-l9 pandemic” where she was required to do damage control (take a guess as to what “damage” had to be controlled…):

Executives are also stated to also show up to company meetings drunk, and she was consistently paraded as one of the only 2 female executives during corporate events.

Beyond that, she was also physically harassed and cornered in her room by a large male executive who was yelling at her for opposing sex-based discrimination and harassment:

What ultimately got her fired though, was speaking up against the massive pay discrepancy between male and female executives:

“At the time of Plaintiff’s termination, Copart had zero women in the C-Suite, only two women on its 11—member Board, and just three of 27 Vice Presidents were female. Indeed, Copart was the very last of the S&P 500 companies to have female board member, and its first and My female C-Suite executive in company history was not appointed until 2022”

“Adding insult to injury, Plaintiff and other female employees were paid significantly less than similarly situated male employees and excluded from substantial stock option grants. When Plaintiff complained of the discrimination and harassment, Copart retaliated against her and ultimately terminated her employment”

Will Franklin, Executive Vice President, the Americas Operations and Worldwide Shared Service, became “outraged” with Plaintiff, to the point where he told plaintiff “not to go there”:

After the plaintiff complained about the compensation disparity between women and men, she had compensation and associated planning functions removed from her responsibilities, which were given to a just a “junior financial analyst who had recently joined the company”.

See below for more details on why she was fired, which honestly…reads as something that truly was retaliatory:

Note that this was the Global VP of HR! If anyone knew of these issues, it would be her.

Anyways, CPRT’s response to this was to argue the definition of sexual harassment…no surprise that their motion to dismiss was denied (note, none of the allegations were admitted being false, so we can likely assume what the plaintiff stated about showing up to company meetings drunk + prostitutes at company events as true).

As a fact check, a Tegus interview earlier this year with a Former CPRT Executive wasn’t too surprised to hear of the above accusations:

“…wouldn't be able to speak to specific details, for example, where there are women who are explicitly prostitutes at company events and behaviors that wouldn't surprise me without knowing specific details of payments and whatnot in the background of things, but appearances do pass an initial glance. It's not a shock or surprise”

“…there's much less structure in place that you'd expect for an organization of their size.”

- Former Executive at CPRT, 5/8/2025

I get the initial pushback here will be that, well, every company in America does this, but does every “compounder” / “best-company-in-the-world” trading at a FY+1 28x P/E multiple & >20x TEV / EBITDA multiple have the above issues? Even beyond that, in a period where IAA is looking the most competitive it has in years, is this how you want key management personnel acting? It just increases the risk of obfuscation in their guide and leads to potential poor execution in an environment that is only getting increasingly competitive and intense.

Utilizing Broker Network to Get Away W/ Severely Damaged Cars + Outright Misleading Postings

A lawsuit filed May 1st, 2025, alleges that CPRT is running a fraudulent system, where they collude with brokers to sell vehicles that are significantly different than advertised.

The lawsuit is titled “Fred Rassaii vs COPART INC. et al” where plaintiff is claiming they lost a substantial sum of money “due to Copart's propagation of falsehood, fraudulent concealment of information, affirmative misrepresentation, and breach of the implied covenant of good faith and fair dealing”.

To summarize, the plaintiff bought 2 cars through an associate broker of CPRT, AAA Auto Sales, and uncovered issues with the vehicle that were not advertised.

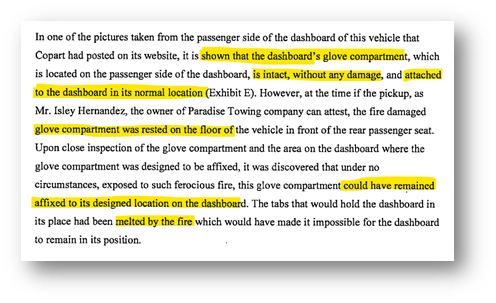

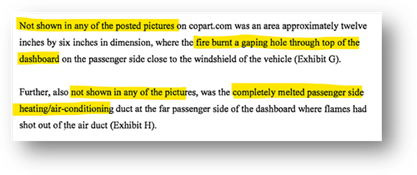

The first vehicle was advertised as "BURN INTERIOR", "MINOR DENT/SCRATCHES", and "Run Drive”. The website had extremely low quality and small size pictures posted of this vehicle, and only upon close inspection would users be able to see minor distortions in the front passenger side floor carpet as the only damage to this vehicle.

After the purchase, at the time and location of the pickup, the plaintiff found that the purchased vehicle actually had catastrophic fire damage to the vehicle's dashboard and the dashboard's underbelly, where most of the vehicle's electronics as well as other electrical/mechanical components are located.

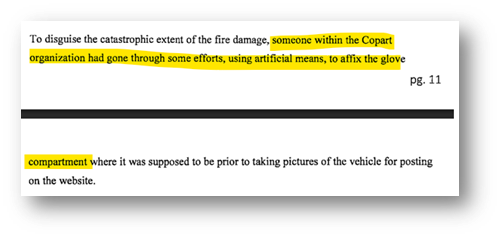

This damage rendered the vehicle completely and entirely useless and dead. Under no circumstances this vehicle, after such catastrophic fire could be started, not to mention "Run Drive" as Copart had claimed on its website. Beyond that, CPRT had potentially made intentional attempts to conceal the extent of the fire damage to this vehicle:

When the plaintiff pushed back, the lot manager said, "You could have inspected the vehicle prior to purchase", then, "You saw the car on the website and you bought what was on the website".

She continued with other excuses in her attempts to refuse the reversal of the sale. When none of her attempts in refusing to reverse the sale of the vehicle could explain and / or justify the falsehood of the vehicle's description and condition stated on CPRT’s website, she stated:

"You are not the owner of the vehicle. Vehicle was purchased by someone else. I can't discuss anything with you about this car."

Even though she claimed that the Plaintiff is not the owner of this vehicle, she insisted that the vehicle must be removed from the site, or the Plaintiff would be charged daily storage fee.

Despite this, the plaintiff bought a second vehicle from CPRT, that came with even worse violations – there was no mention of the vehicle being in an accident, but overwhelming proof that it was:

Hood latch misaligned and no longer aligns with locking mechanism

Entire front assembly (cooling system, radiator, fans, A/C condenser) pushed backward

Components are pressed against the engine block where there should be ~6 inches of clearance

Passenger-side bumper cover loose and hanging

Bumper and fender tabs are broken; pieces misaligned

Indicates significant structural deformation due to a head-on collision

Radiator completely empty of coolant, Water poured into radiator flows directly out from the bottom, puddle of water under vehicle confirms leakage

Fire damage

Lower front end pushed back 6 to 8 inches; upper grill pushed back ~2 inches

A/C condenser and radiator torn apart at center

Attempting to start engine would cause immediate and severe damage due to overheating

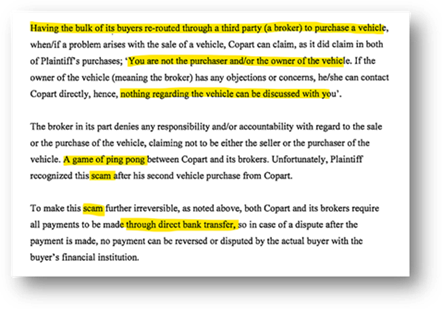

At the end, again, just as the local manager in Jacksonville, this second local manager also stated that:

“…you are not the owner of the vehicle therefore, the vehicle or its condition cannot be discussed with you…”

So, 2 separate managers gave the same prepared response when the plaintiff began pushing back a ton? While not indicative of any malfeasance, that is suspicious. When analyzing these 2 situations, the plaintiff alleges they’ve uncovered the fraudulent CPRT system, which can be paraphrased as the following:

Post low quality pictures of vehicles on website (photos with small size, capacity, and limited pixels – when enlarged, they become blurrier and out of focus)

Take photos from angles that the glare of the sun light, or other lights, into the lens of the camera would mask the extent of the damage to the vehicle

Taking pictures of the vehicle from angles that the damage to the vehicle, in part or as whole, would not be in the frame of the picture

Advertise vehicle as “run and drive”, and then conceal the damage

Place a 3rd party between itself and actual buyer – CPRT then claims the person who searched for the vehicles, etc. is the actual buyer

The brokers for their part claim to have no part in advertising, the sale or the purchase of the vehicle (in some states, you need to have a broker)

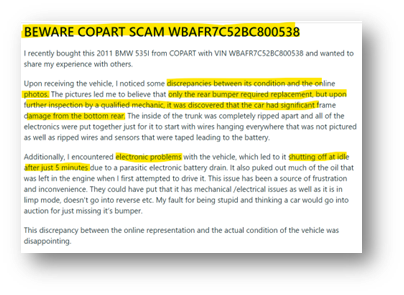

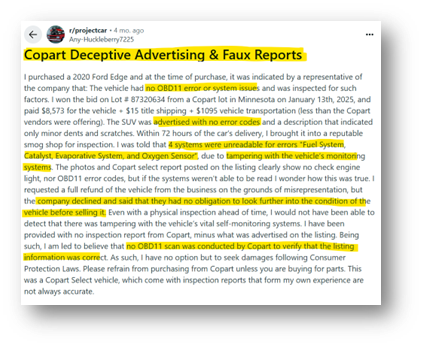

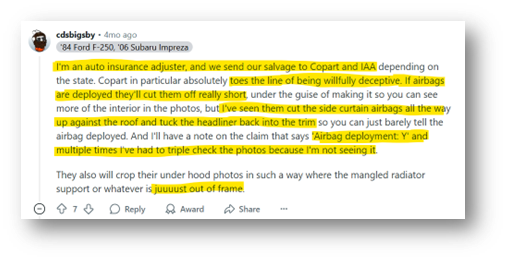

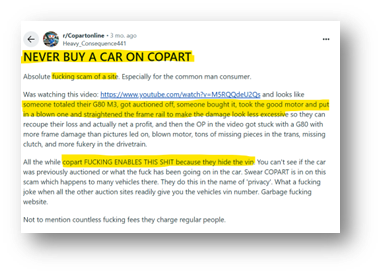

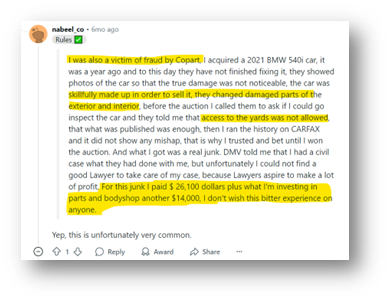

Beyond this lawsuit, looking over the internet, there is also an abundance of reviews suggesting that CPRT is engaging in fraudulent activity.

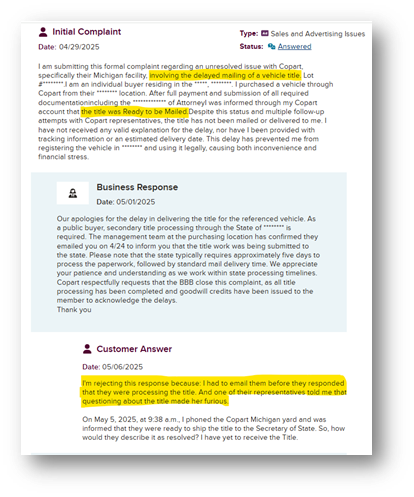

Below is a collection of some customer reviews across Reddit and the BBB that give more color on what might be going on – this seems to go beyond just “oh CPRT sold me a bad car that I didn’t know was a salvage car!” but outright wrong information when looking up the cars VIN; some users found CPRT had the wrong title information / car accident history based off the VIN! If more widespread, this would mean a good chunk of CPRT’s business today relies more on exploiting customers beyond just pricing power, and ought to be investigated:

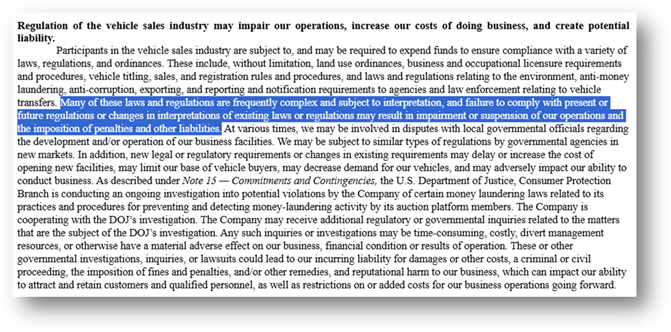

To tie up this section, while not seemingly material, one also has to consider the changes in the risk-disclosure regarding regulation of the vehicle sales industry – see below for the risk-disclosure in the FY2024 10-K:

Now see what was just added in the Q3 FY2025 10-Q; they’ve now included specific wording around the potential of government investigations:

Again, this could very well just be semantics, however, given the timing of these lawsuits and allegations, adding this specific wording is concerning and the cynic in me views this as a red herring than just typical risk disclosure updates.

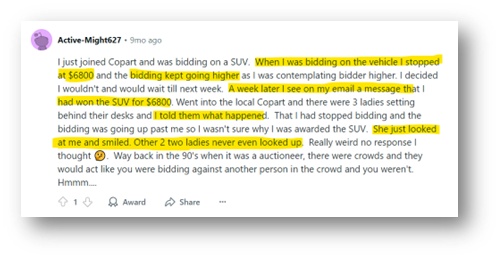

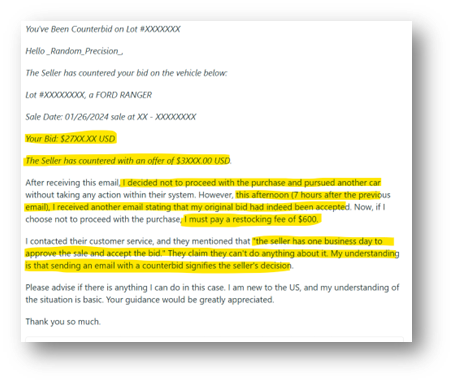

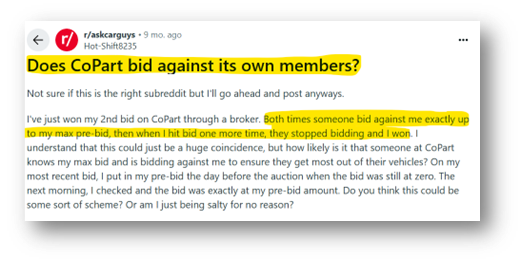

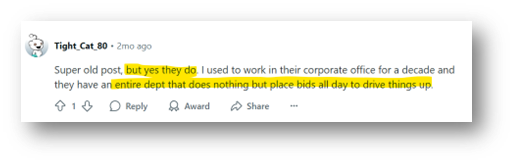

*Not Critical But Interesting* CPRT Engaging in Shill-Bidding?

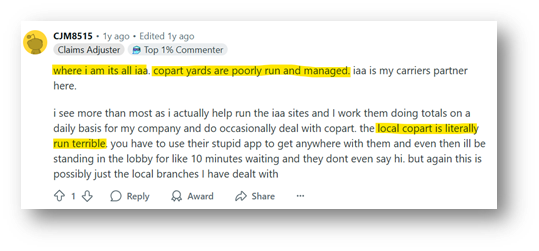

While doing work on the lawsuits above, I came across allegations and accounts of users on Reddit alleging CPRT of shill-bidding, which is defined as “the act of placing bids on an item to artificially inflate its price, desirability, or standing in search results, with no genuine intent to buy it”. Shill-bidding is illegal in many states, and unless explicitly disclosed, would be illegal in CPRT’s case; that being said, irrespective of your view on the “morality” of it, it is something can face scrutiny from regulators.

Below is a collection of screenshots of users’ experiences detailing shill-bidding, and even 1 ex-employee claiming they had an entire department dedicated to shill-bidding!

Fundamental Thesis Commentary: Market Share Normalization Indicates ~20% - ~46% Downside & Minimal Upside

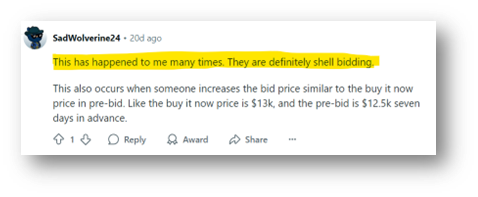

CPRT’s stock has grown at a ~27% CAGR over the last ~10 years – the S&P returned ~13% over the same period. This is largely due to some phenomenal execution from management at the time and capitalizing on weakness in IAA’s business – doing a simplistic breakdown on revenue growth, you can see good chunk of the revenue increase has come from gaining share from IAA, their closest competitor:

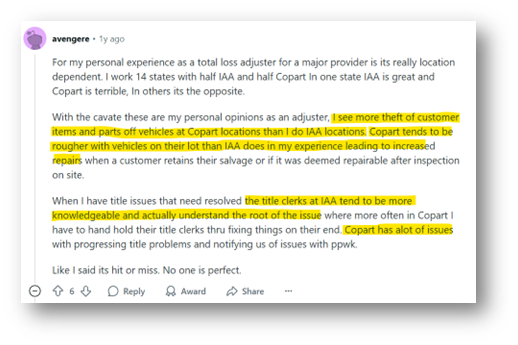

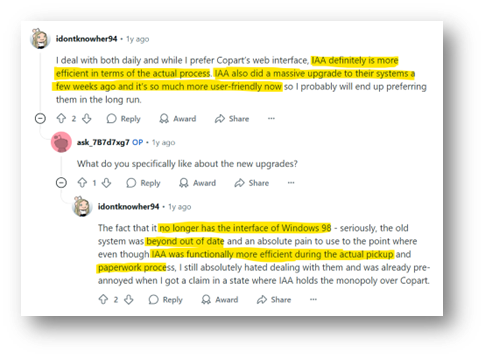

While this has been great for CPRT, IAA primarily struggled as they did not get up to date with the times – their website was dysfunctional, there was little to no investments in growth, etc., largely in part due to their “revolving door” ownership status (being passed around a few times). See below for unit volume growth and share-mix since November 2016 using Yippit data:

So what has changed? Since Ritchi Bros acquired them in March 2023, they seem to be reinvigorated; there is a lot more work on X, VIC, and online about this thesis, so I won’t hamper on too long here but see below for 2 quotes from a Tegus interview in October 2024:

“I mean about 10 years ago, we were almost 100% IAA, but it's had a pretty dramatic shift other way.”

“Same with the catastrophe events, and that was leading to the breakup with IAA with a lot of those when we were seeing it like in the west, the Southwest with a lot of those different catastrophe type events, how they're performing on those large-scale big need type events.”

“I mean they've always performed pretty well in the day-to-day aspects and compare pretty favorably with Copart. Net salvage return has been challenged slightly with Copart having a little bit favorable return to IAA, but where they really struggled was those catastrophe type events”

“I think that they've kind of been reinvigorated. I think even over the last couple of years, it's started just seeing a lot of the market share taken. I think they were very comfortable in where their position was before. They weren't really looking to grow. They weren't really looking to improve upon the position, but I think they have just been too comfortable with where they were and now they're seeing like, okay, we've got the new ownership and management in place there, and we have a lot of the infrastructure and the know-how to do this, so I think that they want to try to reacquire a lot of the market share that they have lost.”

- Claims Supervisor at GEICO (Oct 17, 2024)

Ideally, I would like to list the major take-aways from each Tegus interview, but given that this is a quick piece, I’ll leave it at this; the power lies with the insurance companies that send CPRT the salvage vehicles, and for them, they want as even of a split as possible between the 2 companies as to never be squeezed on terms / have a healthy supplier dynamic.

The insurance companies shifting to CPRT over the last 10 years was more out of a **necessity** factor given the issues at IAA (if your website isn’t even functioning, you aren’t selling as many cars, and in turn, insurance companies are losing money as hosting cars on lots are very expensive).

As a basic check, see below as well for a few Reddit reviews speaking about how IAA has really upped their game recently:

So, going back to the above, when you’re at such a critical inflection point within your industry, is it really a good sign that the key decision makers in your company are potentially engaging in debauchery? Probably not. Anyways, by doing some quick math here, we can project out 3% annual industry growth (conservatively), and try and see what the market is implying for share structure so far:

Current assumptions imply the above – which is that CPRT doesn’t loss significant share. I believe that is unlikely (again, your own customers WANT you to lose share…hard dynamic to win against), and I view a case of share slowly eroding down to 50% by FY 2030, which should in-turn, re-inform the multiple being underwritten at CPRT, which I think causes this to trade down to a 7.0x NTM revenue multiple, resulting in ~25.0% downside:

Personally, I speculate that, if in FY 2026 we see significant share losses, the holder-base will give a lot more credence to the market-share structure normalizing, and underwrite normalized 45% share from 2015, approximated from the below presentation from Luxor, into their terminal case, you can also assume that this would causes the multiple to further contract to 5.0x. Flowing this in, I see ~43% downside:

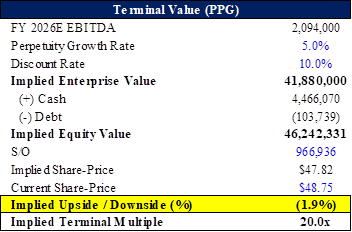

On an EBITDA multiple basis, CPRT currently trades at a ~21x TEV / FY+1 EBITDA multiple; doing some quick math, we can see the market is ascribing ~5% terminal growth:

Assuming CPRT begins to lose share, even seeing a 2-3% being modelled into perpetuity brings the multiple down to ~13.3x:

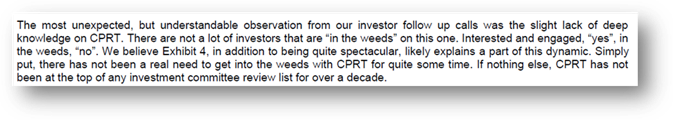

This is all seems too simple…so why hasn’t the market realized this here? See below for a note that X account Ernest Wong shared (these aren’t his words, but a seemingly sell-side note that he shared)

I think the above kind of wraps up the narrative well: this is a company that has done exceptionally well and rewarded investors alongside management handsomely over the last 10 years, giving it the “compounder bro” tag. As such, the multiple expanded >10x, and everyone got rich. As the management team that made this company what it was saw some turn-over, and CPRT grew, leadership can be seen as more focused on having a good time vs. protecting the share-gains they’ve made. Additionally, with how well the business has executed, these last few quarters have been “forgiven” (even with the stock drawing down ~25%) and is why these changes are going unnoticed / the significant valuation premium still remains.

Simply put, the culture amongst some of the leadership team at CPRT leads me to believe that some parts of the company aren’t adequately prepared to defend their share from IAA – to reiterate how real of a threat this is, CPRT’s own customers want IAA to gain share! (same dynamic of insurance companies wanting 1-to-1 market share). Beyond that, you also have allegations that they’ve been engaging in illicit sales of vehicles through their alleged broker scheme alongside other governance risks. At FY+1 multiples of ~21x EBITDA and ~9x revenue, the R/R skew looks attractive here; while I have no position and this is purely a research piece, a pair trade between RBA and CPRT could be attractive.

Interesting post - thank you! I note the 40% to 61% and 50% to 60% MS are different - just difference in data source or? Secondly, you write that “% of gains from share-increase + price” is 108.1% —- by which i take you mean that MORE than the total growth of the industry in that period was from share gains & pricing increases. Interesting, since I thought that the mix of lower accident frequency + higher miles driven + higher TLR had driven volume increases in the last decade as well. If they have grown revenue roughly 3x, but only gained 10%points market share (20% growth on a stand-still basis), how does that account for 108% of growth? Is that just pricing in your view?

Good piece, thanks!

Quick Q, where do you get the info that insurers want 50/50 share? There's an argument to be made that they want a duopoly rather than a monopoly so that they don't get squeezed, but if all insurers were to converge to 50/50 wouldn't that be bad for IAA as Progressive is the fastest growing insurer and skews to IAA rather than Copart?